Frequently Asked Question

How can I start Student Loan deductions for a staff member?

Last Updated 9 years ago

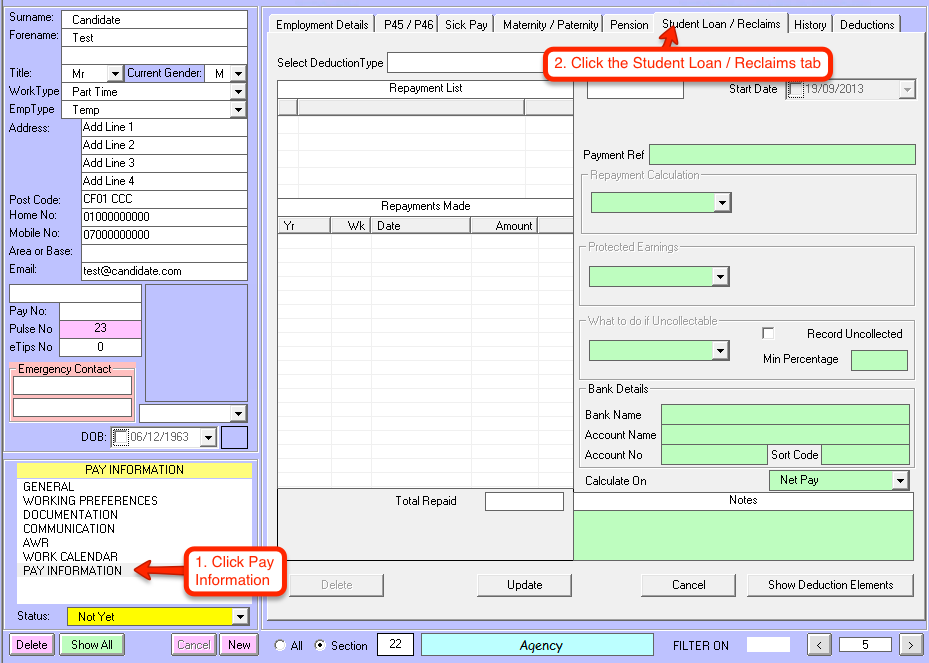

Navigate to the Pay Information section of the staff member’s staff details page, then click the Student Loan / Reclaims tab.

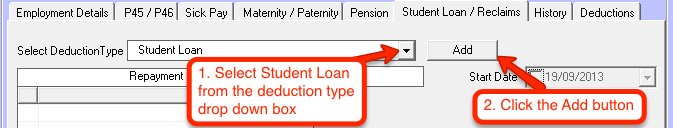

Once you’re there, select Student Loan from the Deduction Type drop down box, then click the “Add” button.

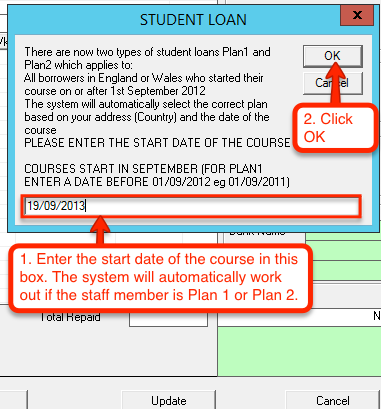

After you’ve pressed that button, a message box will pop up informing you of the different plan types, and which years they apply to. You’ll need to enter the start date of the course and click the OK button. The system will then automatically work out which of the two plans the staff member falls under.

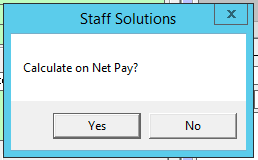

A message box will pop up asking you whether or not you wish to calculate the repayments on Net Pay. Select Yes or No.

This confirmation will then appear, and informs you on how to view extra details about the newly raised debt (as pictured later on).

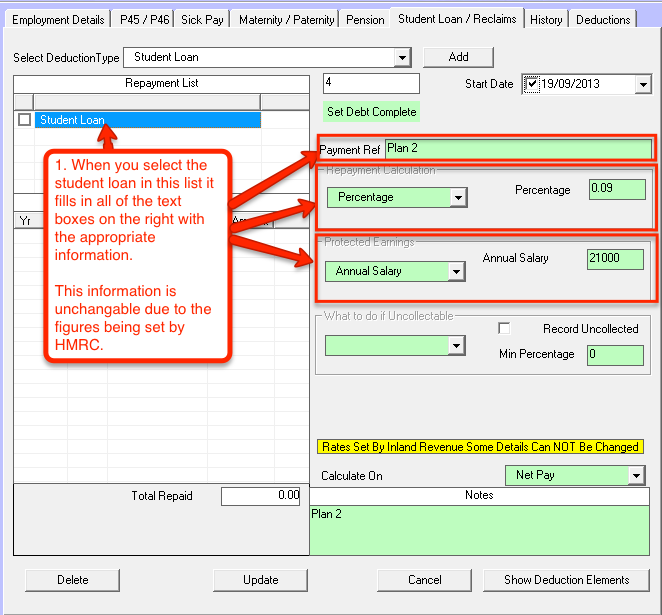

You will now see a new item in the Repayment List entitled Student Loan.

By selecting the Student Loan item in the list, it automatically populates the fields on the right hand side. For Student Loans, these values are unchangeable due to them being set by HMRC.

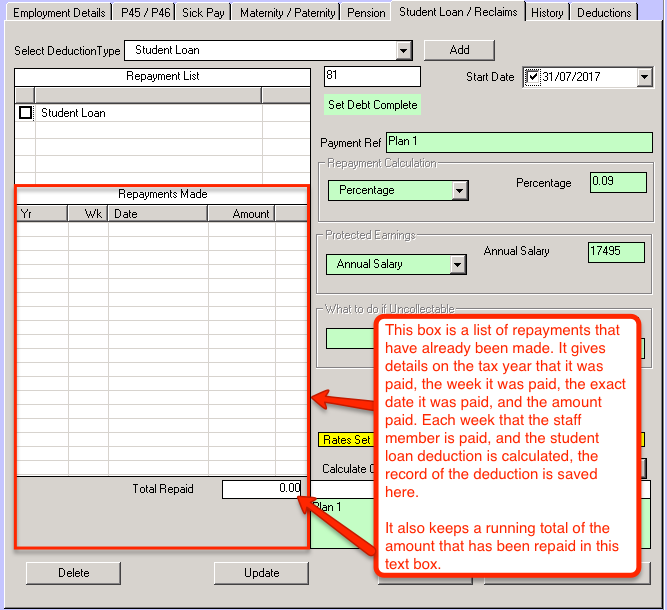

The box located in the bottom left contains a history of the repayments made. The list contains the tax year it was paid, the week number it was paid, the date on which it was paid, and the amount that was paid. The total repaid is also displayed in this area.

Most of the details on this page will be unchangeable for Student Loans because the rates and figures have been set by HMRC. You can change the method that the repayments are calculated by selecting the required option in the Calculate On drop down box, then clicking the Update button near the bottom of the grey window.

You can also change the start date of the deductions the same way. Instead of changing the Calculate On field, change the Start Date field near the top right of the grey window. Once you've amended the date to a date you're happy with, click the Update button and the new start date will be saved.

Once you’re there, select Student Loan from the Deduction Type drop down box, then click the “Add” button.

After you’ve pressed that button, a message box will pop up informing you of the different plan types, and which years they apply to. You’ll need to enter the start date of the course and click the OK button. The system will then automatically work out which of the two plans the staff member falls under.

A message box will pop up asking you whether or not you wish to calculate the repayments on Net Pay. Select Yes or No.

This confirmation will then appear, and informs you on how to view extra details about the newly raised debt (as pictured later on).

You will now see a new item in the Repayment List entitled Student Loan.

By selecting the Student Loan item in the list, it automatically populates the fields on the right hand side. For Student Loans, these values are unchangeable due to them being set by HMRC.

The box located in the bottom left contains a history of the repayments made. The list contains the tax year it was paid, the week number it was paid, the date on which it was paid, and the amount that was paid. The total repaid is also displayed in this area.

Most of the details on this page will be unchangeable for Student Loans because the rates and figures have been set by HMRC. You can change the method that the repayments are calculated by selecting the required option in the Calculate On drop down box, then clicking the Update button near the bottom of the grey window.

You can also change the start date of the deductions the same way. Instead of changing the Calculate On field, change the Start Date field near the top right of the grey window. Once you've amended the date to a date you're happy with, click the Update button and the new start date will be saved.