Frequently Asked Question

How can I start Maternity pay for an employee?

Last Updated 9 years ago

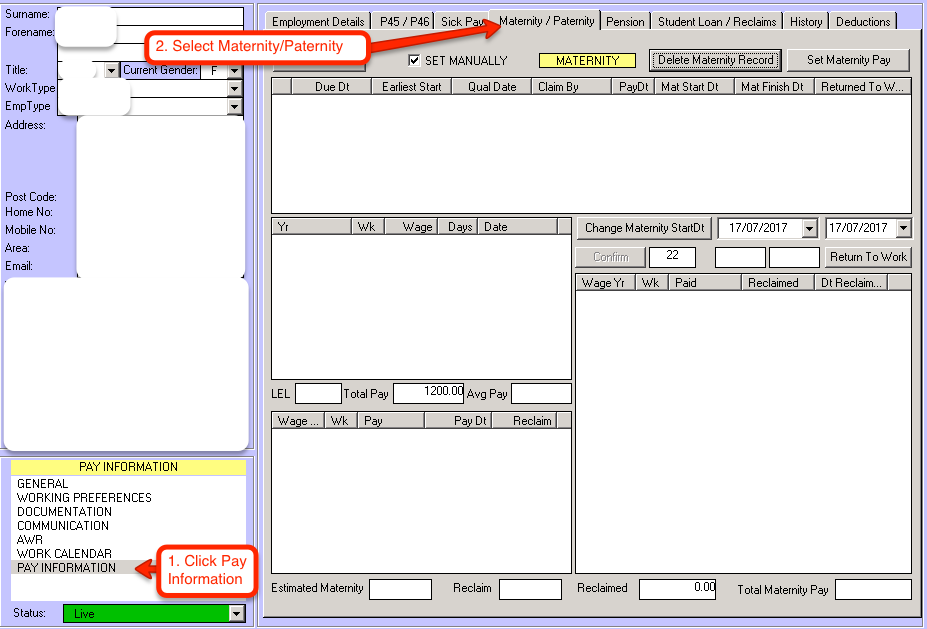

First, navigate to the pay information section of the employee. From here, select the Maternity/Paternity tab (it’s the 4th one across).

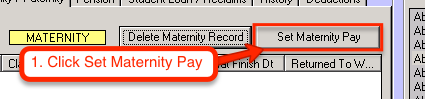

Once you’re on the Maternity/Paternity window, click the Set Maternity Pay button towards the top right of the grey window.

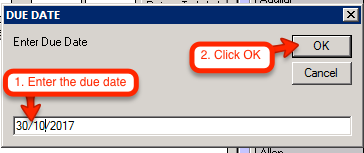

Enter the due date of the child in the text box that pops up, then press OK.

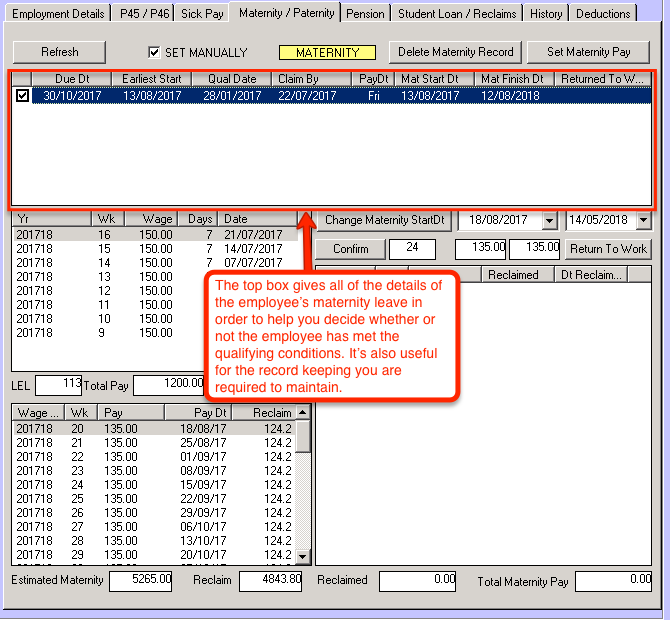

This window is separated into various boxes. The top one shows the information of the newly created Maternity Pay period. It includes information on the earliest start, the date that the employee qualified for maternity pay, the date they have to give notice that they are claiming maternity pay, the pay day of each maternity payment, the chosen maternity pay start date, and the date they returned to work (this column will be used towards the end of their maternity pay period if they decide to return to work early).

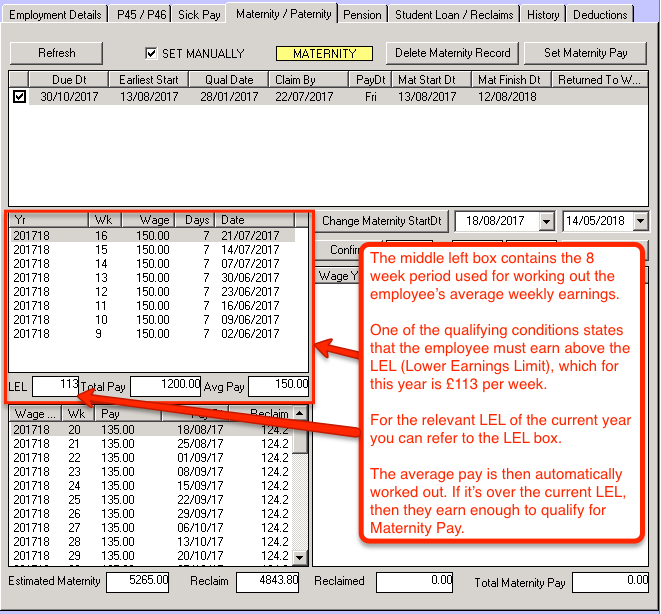

The middle left box shows the earnings of the employee during the 8 week period used for working out the average weekly pay. The average pay figure is used to determine whether or not the employee earns more than the Lower Eanings Limit (LEL) threshold required for claiming maternity pay.

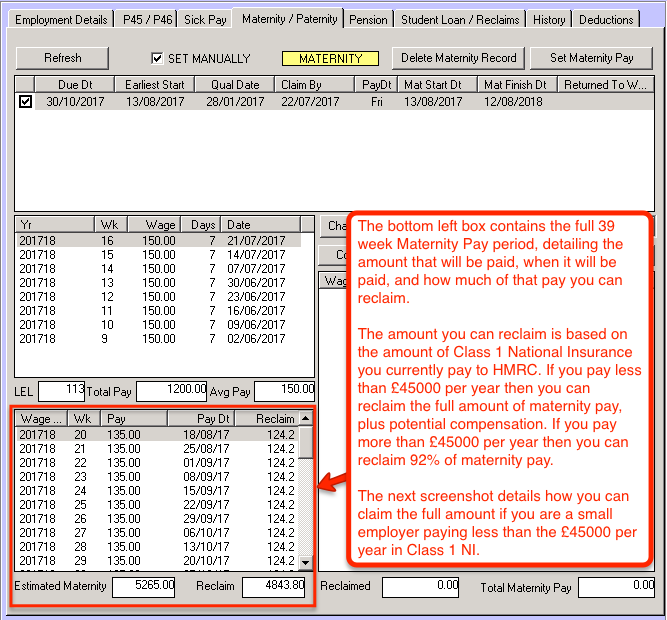

The bottom left box shows the full 39 week period of Maternity Pay. It contains the tax year when it will be paid, the week, the actual amount that will be paid, the date that it will be paid, and the amount of maternity pay that you as an employer can reclaim from HMRC.

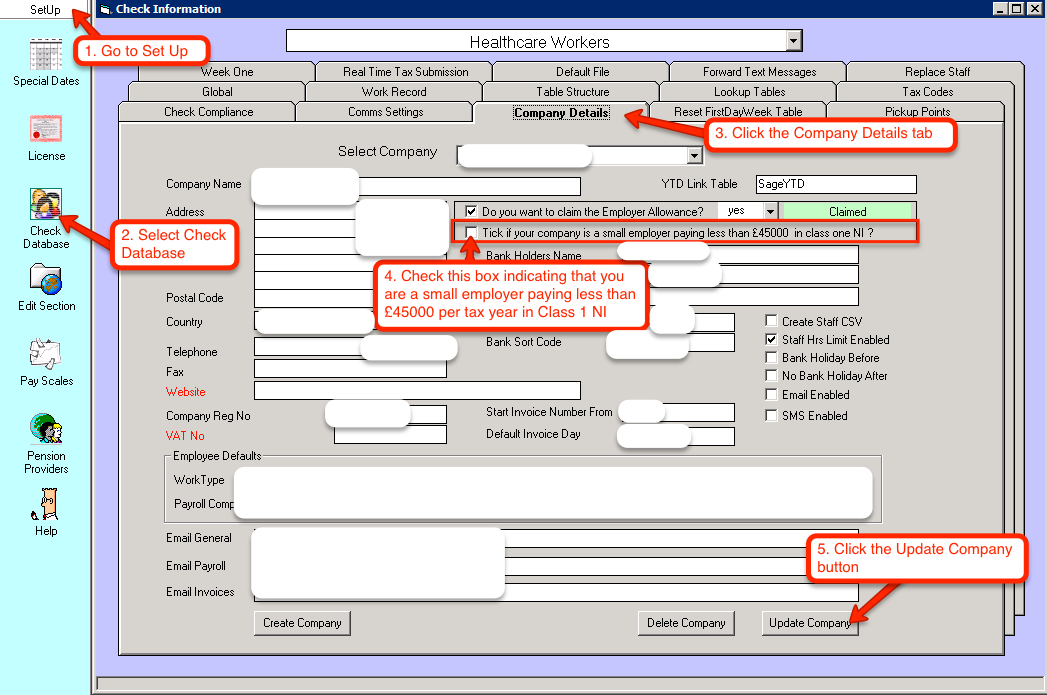

If you are a small employer that can claim the full amount of maternity pay plus compensation, you will need to set up Pulse to recognise this.

First navigate to Set Up.

Then select Check Database.

When the Check Database window shows up select the Company Details tab.

There you will see a checkbox asking if you are a small employer paying less than £45000 a year in class 1 NI. If this is true, tick the box, then press the Update Company button.

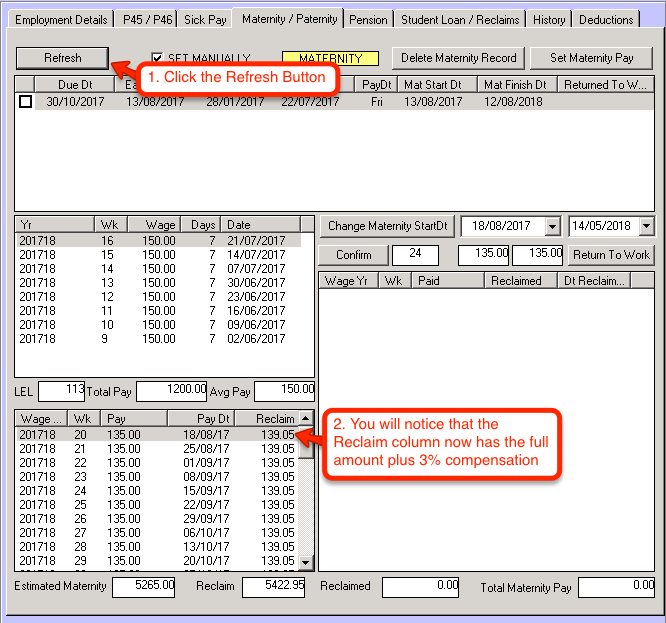

When you go back to the employee and click the Refresh button on the Maternity/Paternity section, the reclaim value in the bottom left box will update to reflect the 103% reclaimable pay.

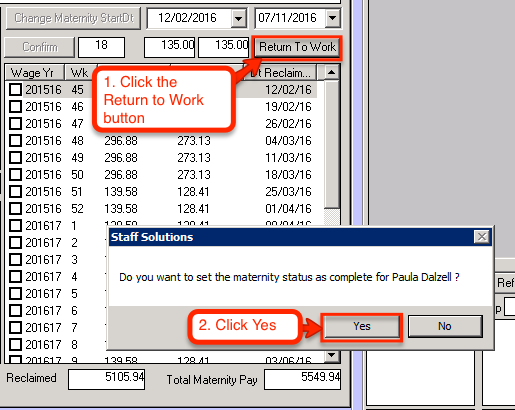

The bottom right box contains the history of maternity payments. It includes the details of when each payment was made, how much each payment amounted to, and how much you reclaimed from that payment. This box helps in keeping the records that are required by HMRC. The example image below shows a previous maternity payment period for an employee.

If the employee wants to return to work early, you can set the return to work date by clicking the “Return to Work” button then confirming it by clicking “Yes” on the message box.

Enter the date they wish to return to work in the next message box that pops up. The date must be in DD/MM/YYYY format.

(Note: According to HMRC, employees must give you 8 weeks notice before the date that they wish to return to work, if they decide to return early)

Once you’re on the Maternity/Paternity window, click the Set Maternity Pay button towards the top right of the grey window.

Enter the due date of the child in the text box that pops up, then press OK.

This window is separated into various boxes. The top one shows the information of the newly created Maternity Pay period. It includes information on the earliest start, the date that the employee qualified for maternity pay, the date they have to give notice that they are claiming maternity pay, the pay day of each maternity payment, the chosen maternity pay start date, and the date they returned to work (this column will be used towards the end of their maternity pay period if they decide to return to work early).

The middle left box shows the earnings of the employee during the 8 week period used for working out the average weekly pay. The average pay figure is used to determine whether or not the employee earns more than the Lower Eanings Limit (LEL) threshold required for claiming maternity pay.

The bottom left box shows the full 39 week period of Maternity Pay. It contains the tax year when it will be paid, the week, the actual amount that will be paid, the date that it will be paid, and the amount of maternity pay that you as an employer can reclaim from HMRC.

If you are a small employer that can claim the full amount of maternity pay plus compensation, you will need to set up Pulse to recognise this.

First navigate to Set Up.

Then select Check Database.

When the Check Database window shows up select the Company Details tab.

There you will see a checkbox asking if you are a small employer paying less than £45000 a year in class 1 NI. If this is true, tick the box, then press the Update Company button.

When you go back to the employee and click the Refresh button on the Maternity/Paternity section, the reclaim value in the bottom left box will update to reflect the 103% reclaimable pay.

The bottom right box contains the history of maternity payments. It includes the details of when each payment was made, how much each payment amounted to, and how much you reclaimed from that payment. This box helps in keeping the records that are required by HMRC. The example image below shows a previous maternity payment period for an employee.

If the employee wants to return to work early, you can set the return to work date by clicking the “Return to Work” button then confirming it by clicking “Yes” on the message box.

Enter the date they wish to return to work in the next message box that pops up. The date must be in DD/MM/YYYY format.

(Note: According to HMRC, employees must give you 8 weeks notice before the date that they wish to return to work, if they decide to return early)