Frequently Asked Question

How can I enter an employee's P45/P46 information?

Last Updated 9 years ago

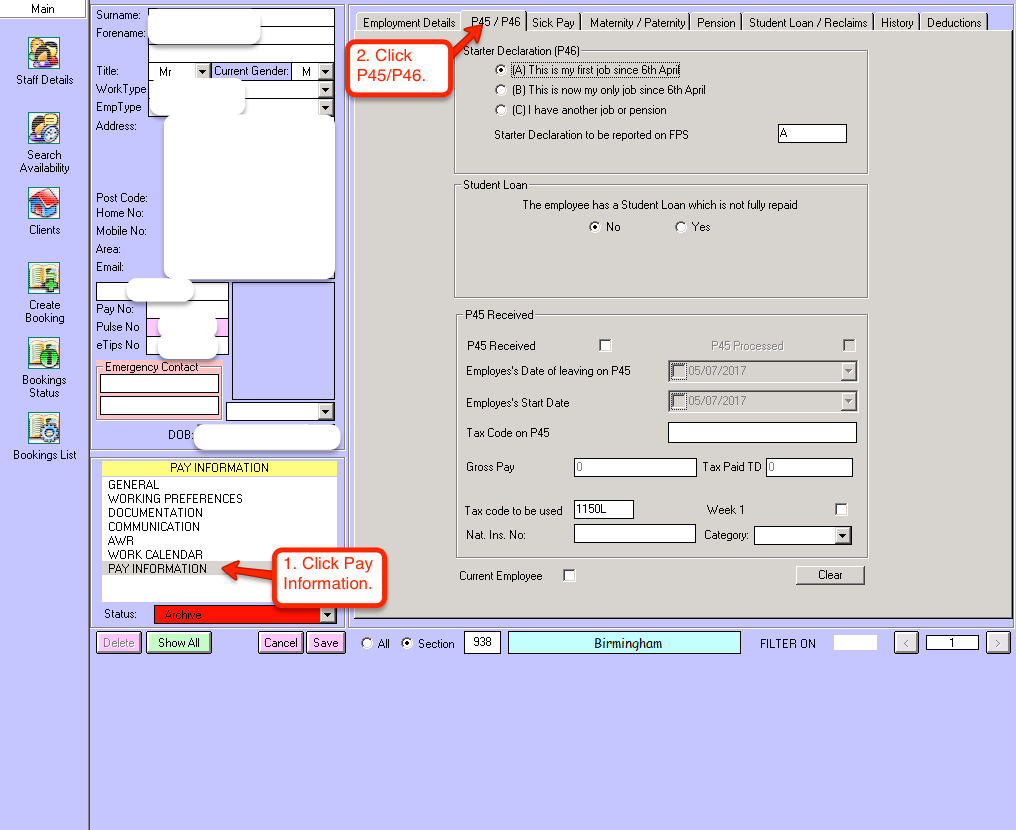

First, navigate to the employee's pay information, then click on the second tab titled "P45/P46".

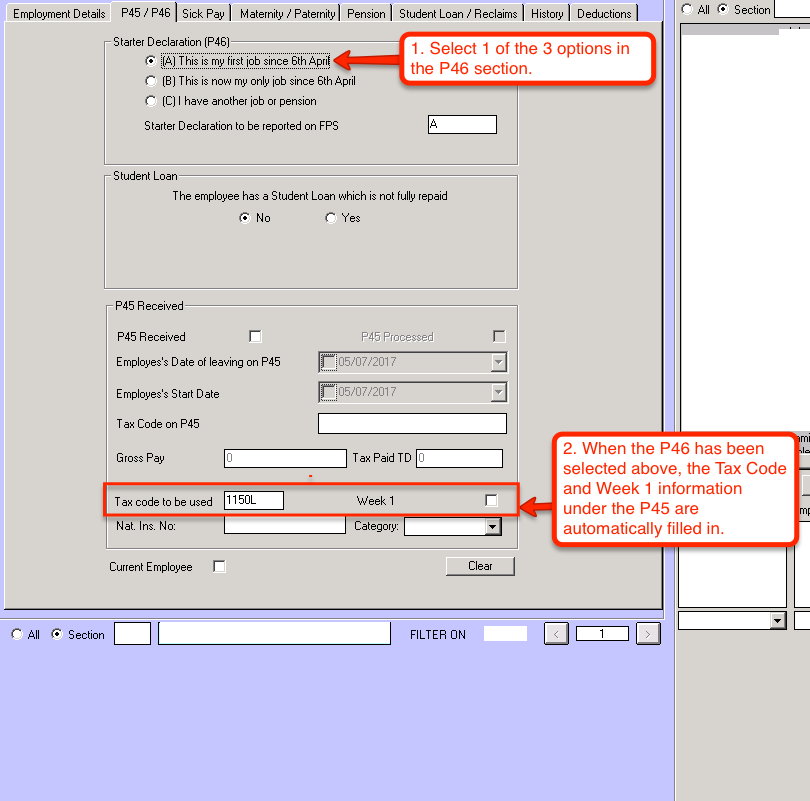

From here you can see the list of 3 options for the P46. When you select the most suitable option for the employee, the tax code and week 1 status are automatically updated.

1150L tax code means that the employee has £11,500 tax free income, meaning any income above that threshold is taxed. The tax free income is worked out by multiplying the tax code number by 10 (1150*10=11,500).

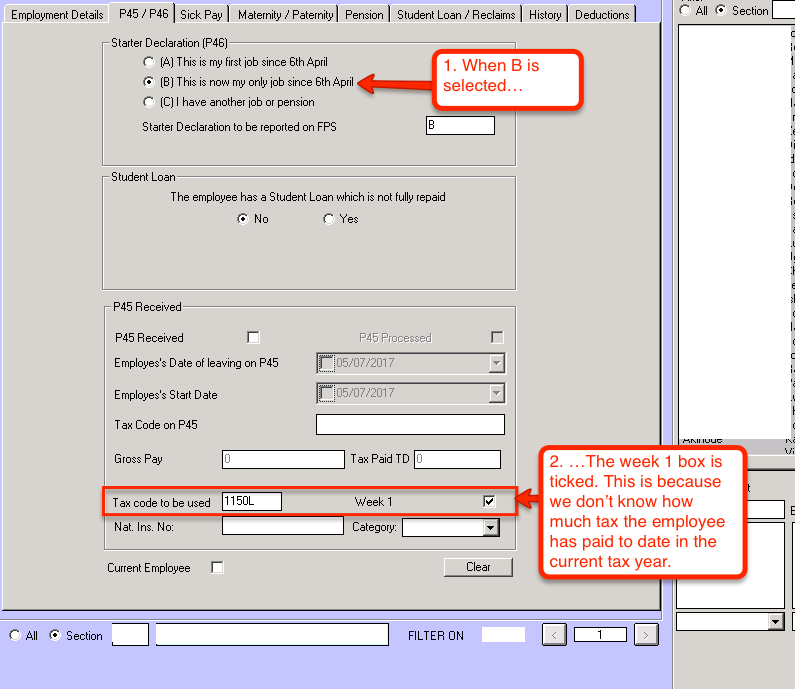

The employee is automatically set to Week 1 because at the moment we don’t know how much tax they’ve paid to date from their previous job in the current tax year. This means that the employee cannot accumulate tax paid to date, and future tax payments until the next tax year must be calculated as if they are on week 1.

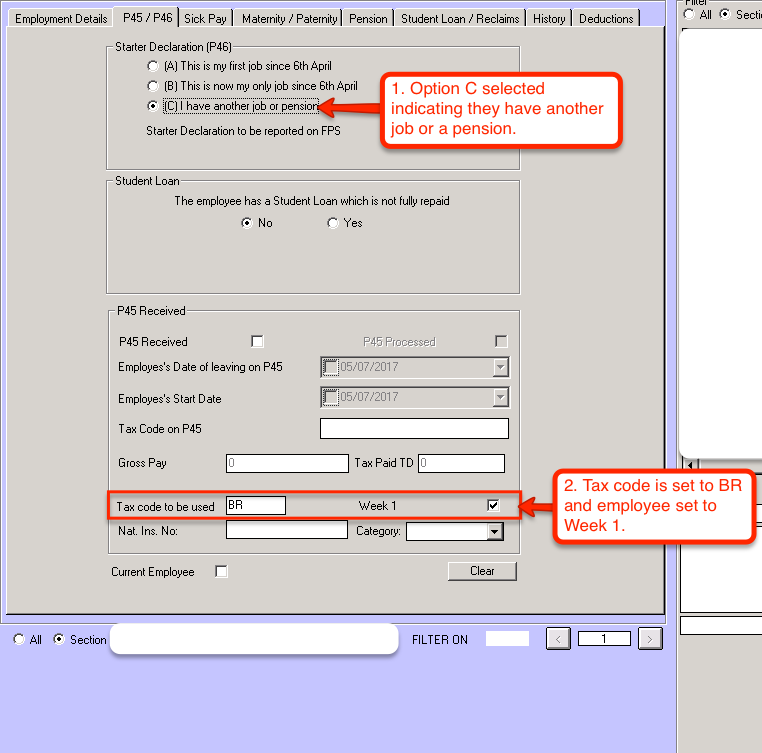

The employee’s tax code is set to Basic Rate, which means all of their income is taxed at a rate of 20% without any tax free income. They are also set to week 1 because we don’t know how much tax they are paying from their other job.

If you have the P45 of the employee you can fill in all of the information in the "P45 Received" section of this window. You'll need to check the P45 Received box then fill in the corresponding information. Note: If you don't have their gross pay or tax paid to date you will need to check the week 1 box as we don't know how much tax has been paid in the current year so far.

From here you can see the list of 3 options for the P46. When you select the most suitable option for the employee, the tax code and week 1 status are automatically updated.

1150L tax code means that the employee has £11,500 tax free income, meaning any income above that threshold is taxed. The tax free income is worked out by multiplying the tax code number by 10 (1150*10=11,500).

The employee is automatically set to Week 1 because at the moment we don’t know how much tax they’ve paid to date from their previous job in the current tax year. This means that the employee cannot accumulate tax paid to date, and future tax payments until the next tax year must be calculated as if they are on week 1.

The employee’s tax code is set to Basic Rate, which means all of their income is taxed at a rate of 20% without any tax free income. They are also set to week 1 because we don’t know how much tax they are paying from their other job.

If you have the P45 of the employee you can fill in all of the information in the "P45 Received" section of this window. You'll need to check the P45 Received box then fill in the corresponding information. Note: If you don't have their gross pay or tax paid to date you will need to check the week 1 box as we don't know how much tax has been paid in the current year so far.