Frequently Asked Question

How can I start attachment of earnings for a staff member?

Last Updated 9 years ago

When setting up attachment of earnings for a staff member, you may have received deduction information from the creditor who filed the attachment of earnings/deduction from earnings order. This information details the pay brackets and how much pay is deducted each pay period. There are 3 default deduction tables in the system which you may be able to use, but there are also options for custom tables if the information you have received is more unique to the employee.

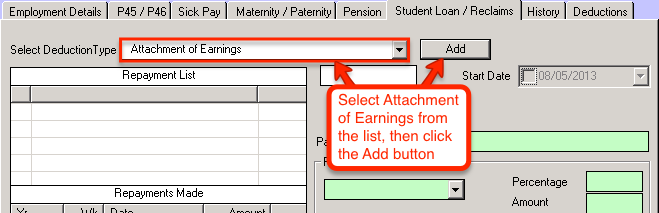

Select Attachment of Earnings from the drop down box then click the Add button.

[insert screenshot]

If Attachment of Earnings isn't showing up in the drop down box, follow the next section to check if you have it set up correctly.

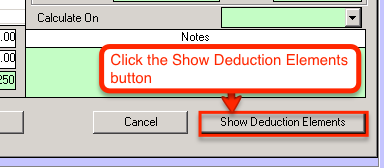

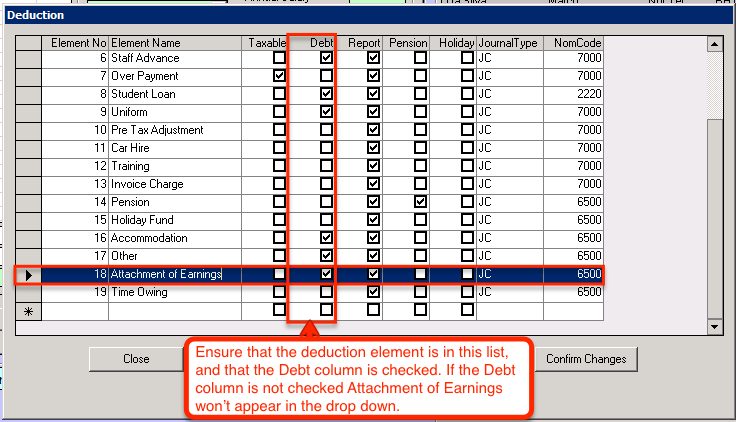

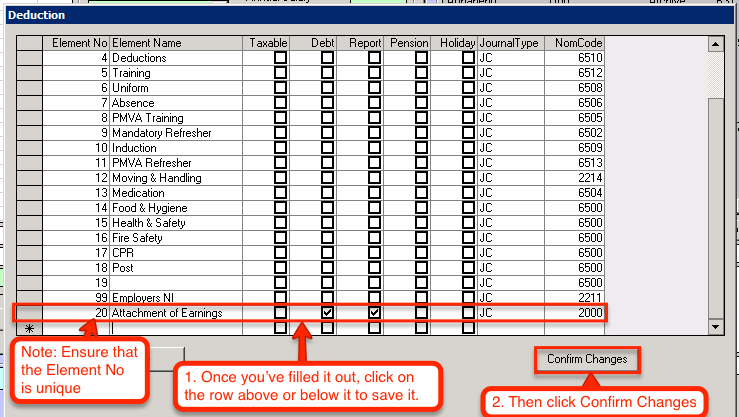

1. You may need to set the Attachment of Earnings deduction element to a "Debt" if it's not showing up in the list.

Click the Show Show Deduction Elements button.

Check the "Debt" column on your Attachment of Earnings deduction element.

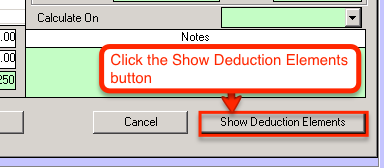

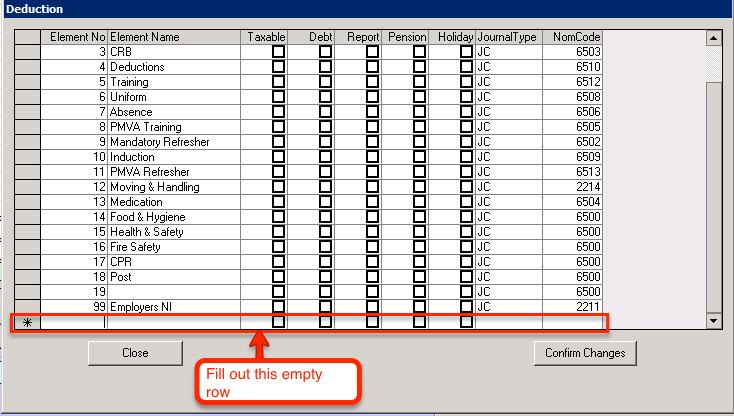

2. If you can't see the Attachment of Earnings deduction type in the drop down menu OR the Deduction Elements list you may not have a deduction element set up for Attachment of Earnings. To check this, click the Show Deduction Elements button.

If there's no Attachment of Earnings deduction element, add it by typing in the empty row with the star.

(Note: It is important to ensure that the Element No field is unique)

Once you've entered your new deduction element, save it by clicking off the newly created row, then click the Confirm Changes button.

Select Attachment of Earnings and Click the Add button.

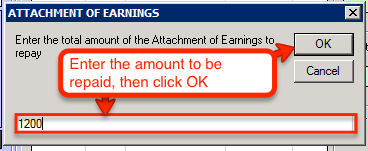

Enter the amount to be repaid, this information will be found on any of the documents that were sent to you regarding the staff member's Attachment of Earnings order.

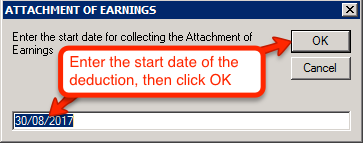

Enter the start date of the collection period for the Attachment of Earnings.

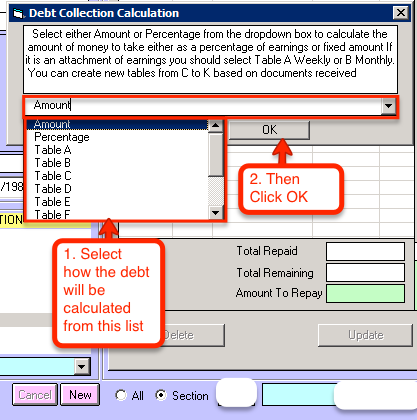

Choose a collection calculation method. For Amount and Percentage, the deductions will be a fixed amount each week/month. For the Tables, the deductions will vary based on how much money the employee makes in that week/month. The tables are explained in the upcoming section "The Differences Between Tables A, B, and C".

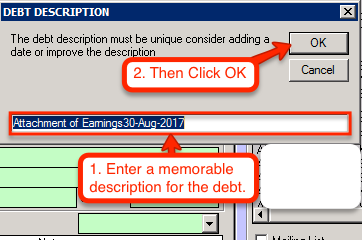

Give the attachment of earnings a description so that is easy to identify in the future.

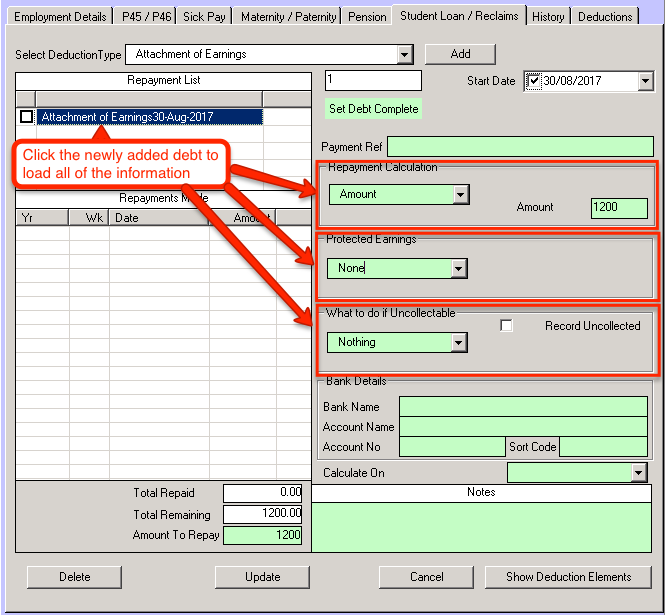

To load the repayment information, click on the newly added Attachment of Earnings record in the "Repayment List".

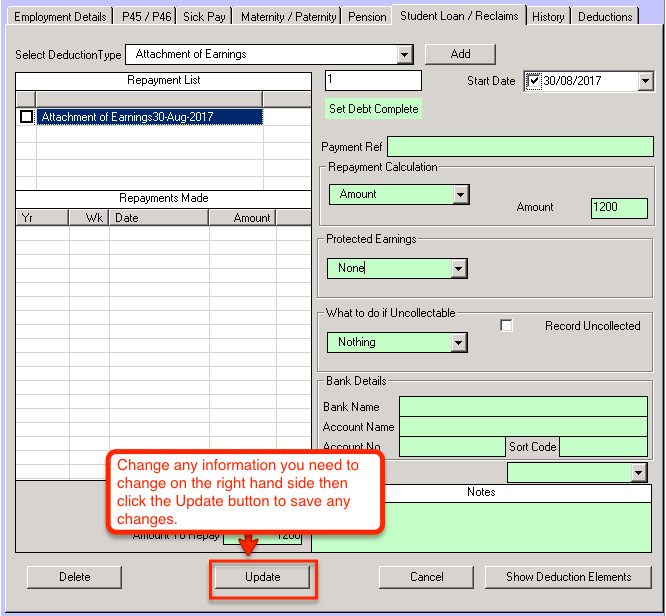

If you need to make any changes to the Repayment Calculation, the Protected Earnings, or What to do if Uncollectable, change the information required then click the Update button near the bottom of the window.

It is worth checking the current deduction tables on your system to make sure that the employee will end up paying the correct amount each period.

To do this, we can load up any previous week or month payroll and check any employee with an existing attachment of earnings style deduction. A student loan, for example.

[screenshot]

(Note: If you don't have any staff members with any extra deductions such as student loans, you can add the attachment of earnings as normal, then alter the table values the same way as above before the pay period when the deductions start to take place).

Once you have found an employee with a student loan, double click the deduction in the bottom right box and a window will appear.

[screenshot]

From here you can check the “Use Table” box to show the table values at the bottom of the window.

[screenshot]

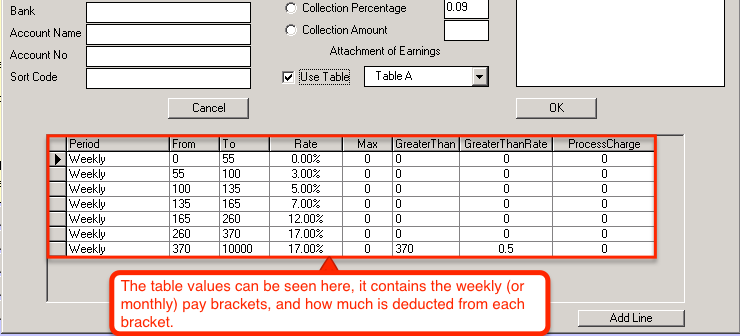

Table A is the default deduction table used for calculating attachment of earnings on the Weekly pay period.

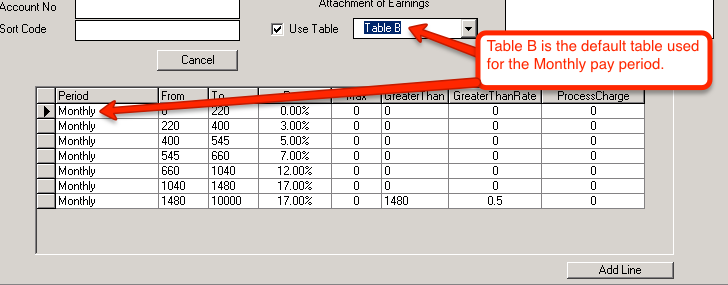

Table B is the default deduction table used for calculating attachment of earnings on the Monthly pay period.

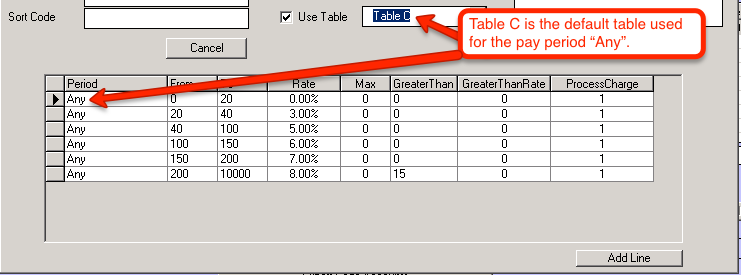

Table C is the default deduction table for calculating attachment of earnings on the pay period “Any”.

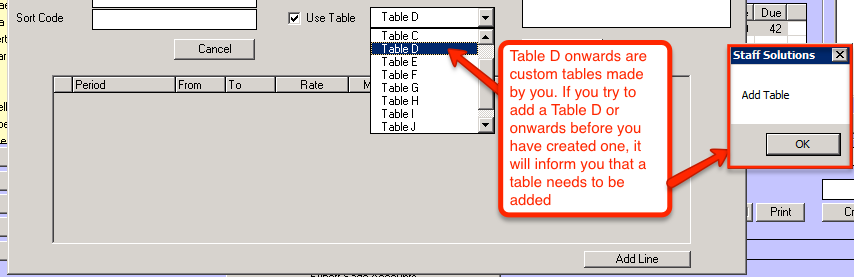

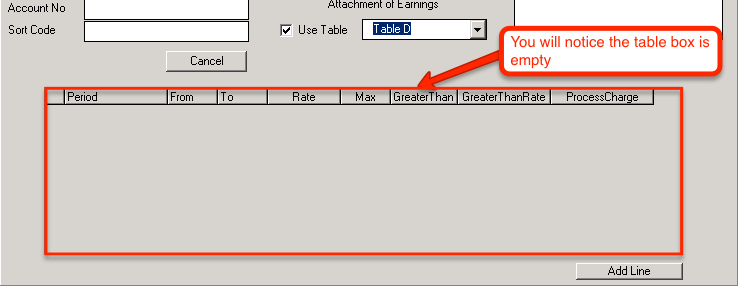

Table D onward are designated for custom deduction tables. If you have already created a custom deduction table under one of these it will show up as normal, but if you are yet to create a custom deduction table and you try to allocate it, a message box will pop up informing you to add a table.

As you can see, the table box is empty due to there being no table created under Table D.

Select Attachment of Earnings from the drop down box then click the Add button.

[insert screenshot]

If Attachment of Earnings isn't showing up in the drop down box, follow the next section to check if you have it set up correctly.

Attachment of Earnings is not showing up in the drop down box

1. You may need to set the Attachment of Earnings deduction element to a "Debt" if it's not showing up in the list.

Click the Show Show Deduction Elements button.

Check the "Debt" column on your Attachment of Earnings deduction element.

2. If you can't see the Attachment of Earnings deduction type in the drop down menu OR the Deduction Elements list you may not have a deduction element set up for Attachment of Earnings. To check this, click the Show Deduction Elements button.

If there's no Attachment of Earnings deduction element, add it by typing in the empty row with the star.

(Note: It is important to ensure that the Element No field is unique)

Once you've entered your new deduction element, save it by clicking off the newly created row, then click the Confirm Changes button.

Select Attachment of Earnings and Click the Add button.

Enter the amount to be repaid, this information will be found on any of the documents that were sent to you regarding the staff member's Attachment of Earnings order.

Enter the start date of the collection period for the Attachment of Earnings.

Choose a collection calculation method. For Amount and Percentage, the deductions will be a fixed amount each week/month. For the Tables, the deductions will vary based on how much money the employee makes in that week/month. The tables are explained in the upcoming section "The Differences Between Tables A, B, and C".

Give the attachment of earnings a description so that is easy to identify in the future.

To load the repayment information, click on the newly added Attachment of Earnings record in the "Repayment List".

If you need to make any changes to the Repayment Calculation, the Protected Earnings, or What to do if Uncollectable, change the information required then click the Update button near the bottom of the window.

It is worth checking the current deduction tables on your system to make sure that the employee will end up paying the correct amount each period.

To do this, we can load up any previous week or month payroll and check any employee with an existing attachment of earnings style deduction. A student loan, for example.

[screenshot]

(Note: If you don't have any staff members with any extra deductions such as student loans, you can add the attachment of earnings as normal, then alter the table values the same way as above before the pay period when the deductions start to take place).

Once you have found an employee with a student loan, double click the deduction in the bottom right box and a window will appear.

[screenshot]

From here you can check the “Use Table” box to show the table values at the bottom of the window.

[screenshot]

The Differences between Tables A, B, and C

The values of the different deduction tables are located in the box near the bottom of the window. This table contains the different pay brackets and the rate of pay that gets deducted for each one.Table A is the default deduction table used for calculating attachment of earnings on the Weekly pay period.

Table B is the default deduction table used for calculating attachment of earnings on the Monthly pay period.

Table C is the default deduction table for calculating attachment of earnings on the pay period “Any”.

Table D onward are designated for custom deduction tables. If you have already created a custom deduction table under one of these it will show up as normal, but if you are yet to create a custom deduction table and you try to allocate it, a message box will pop up informing you to add a table.

As you can see, the table box is empty due to there being no table created under Table D.