Frequently Asked Question

Setting an Employee as Self Employed

Last Updated 9 years ago

Pulse Software allows staff to be set up as Self Employed. The same procedure applies whether the person is self employed or a Limited Company

When an employee is Self Employed their timesheets will be processed with a separate rate of pay to those paid through the PAYE payroll. Holiday Pay will not be calculated, neither will employers NI be calculated.

Self Employed staff timesheets will be processed through the to the Wages Screen and split in the Payslips screen into Invoice (Self Employed) and Payslip (Paye). The invoice produced for self employed staff is basically your remittance advice to them for the shifts worked. You can if you wish charge the individual for creating their invoice by posting a deduction to the employee.

To set up Self Employed staff correctly we will start with the Staff Details Screen on the Main Menu:

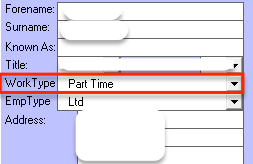

Work Type: Should be Part Time

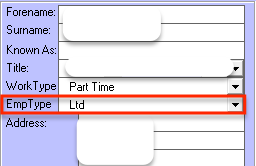

Emp Type: Should be Limited

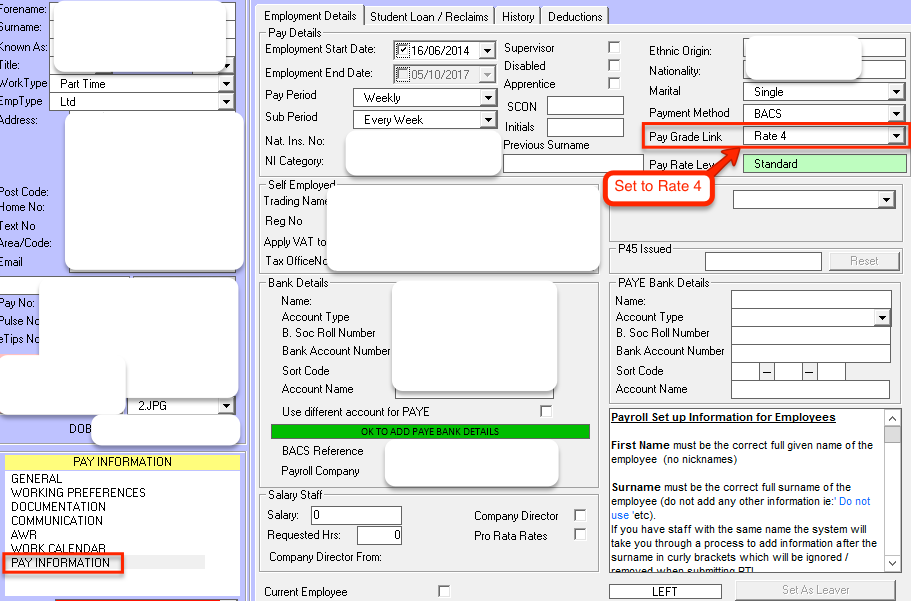

Pay Details: Should be Rate 4

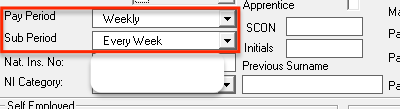

Period: Every Week

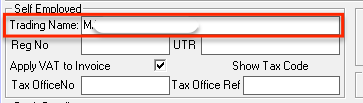

Under the Self Employed details enter their trading name

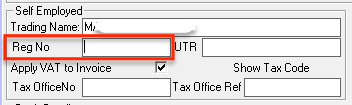

Under 'Reg No' enter the Registration Number if you have it.

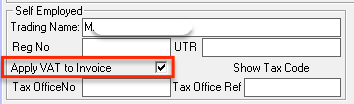

You can also choose whether or not to apply VAT to invoices sent to the staff member by checking the Apply VAT to Invoice.

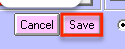

Click 'Save'

The employee is now set up correctly.

When an employee is Self Employed their timesheets will be processed with a separate rate of pay to those paid through the PAYE payroll. Holiday Pay will not be calculated, neither will employers NI be calculated.

Self Employed staff timesheets will be processed through the to the Wages Screen and split in the Payslips screen into Invoice (Self Employed) and Payslip (Paye). The invoice produced for self employed staff is basically your remittance advice to them for the shifts worked. You can if you wish charge the individual for creating their invoice by posting a deduction to the employee.

To set up Self Employed staff correctly we will start with the Staff Details Screen on the Main Menu:

Work Type: Should be Part Time

Emp Type: Should be Limited

Pay Details: Should be Rate 4

Period: Every Week

Under the Self Employed details enter their trading name

Under 'Reg No' enter the Registration Number if you have it.

You can also choose whether or not to apply VAT to invoices sent to the staff member by checking the Apply VAT to Invoice.

Click 'Save'

The employee is now set up correctly.